Business Owners!

You need funding to grow your business?

$25k Minimum

4 Days to recieve funding

Business Loan Options

Whats Your Senario

Every business faces unique challenges and opportunities. Whether you need funds to cover marketing expenses, expand your operations, or simply manage cash flow, MarketingBudget.app can help. Explore how other business owners, just like you, have successfully secured funding and grown their businesses in days

Business Loans

Get the funding you need fast and easy.

Small Business Funding

Creative funding solutions

Startup Capital

Kickoff your business journey with financing.

Marketing Budget

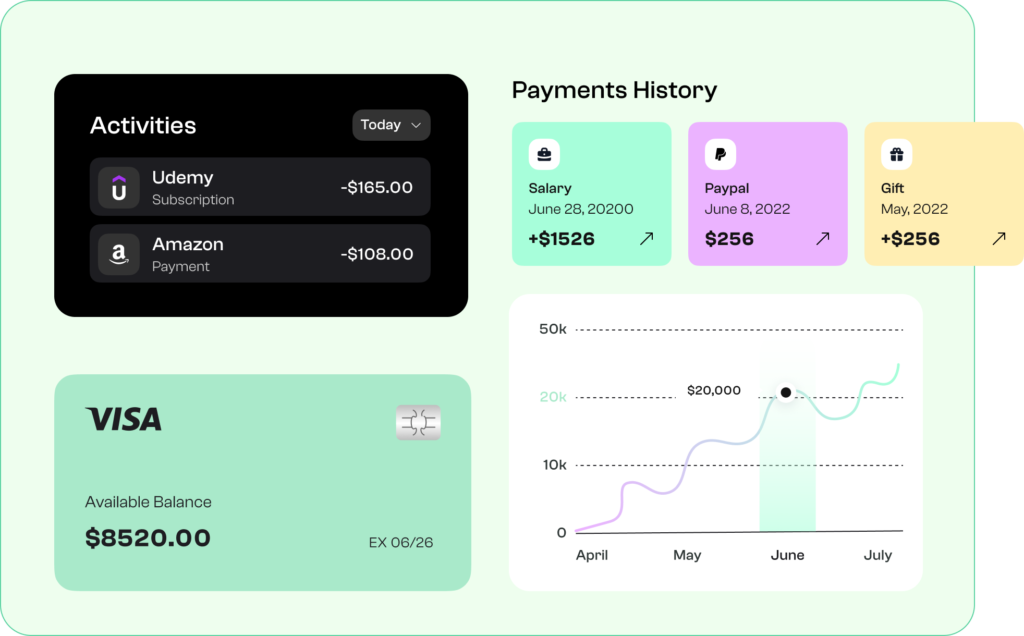

Keep track and manage your loan through the app

Know your business expenses and see exactly where your money goes.

Integration with CRM

Once setup, you can manage your money and allocate funds towards your specific needs.

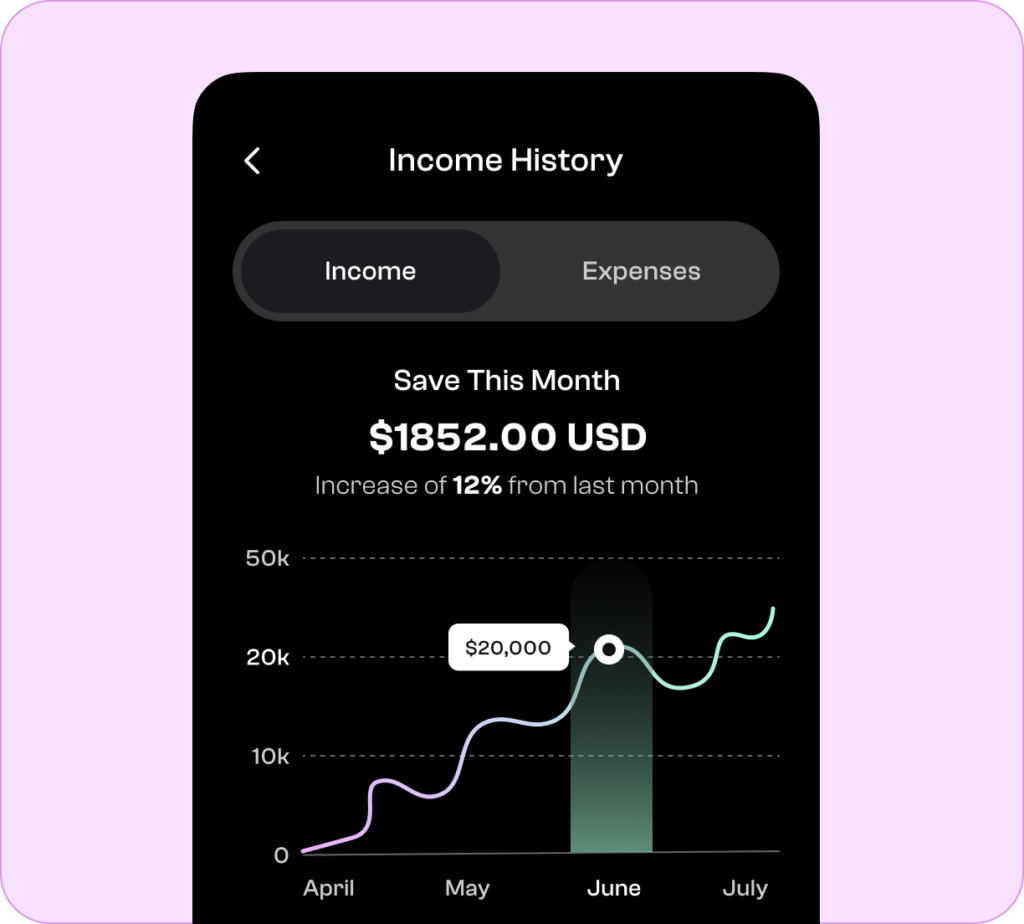

Delivering results

If you forcasted your marketing budget properly, you can learn to market your business effectively.

Double Down on what works

This is a gambling phase where you reinvest in the strategy that generates revenue.

Get Your Money Fast

Our skillful process allows you to maximize your business potential

In most cases, we can get you financed for any business loan approved and available to use right away. Use the cash to grow your business profitably.

CASE STUDIES

Discover how other business owners were approved for their loans

Every person has a different story. From bad credit, no declared income, and lack of assets, there are more solutions than there are problems. Where there is a will, there is a way to get financed for your business.

“Needed a business loan badly. To stay afloat and use some of my marketng budget to reach more people on social media.

After a good look of our options, Carlos was able to get me a loan even with poor credit.

Now, I have just what I need to promote my business to the next level.”

Daniel Belu

Manager, USA

“Starting off from the bottom now I’m here. I couldn’t get a brake from any traditional business loans. I needed just enough to promote an event where I can share my products to the world.

Everything worked out. The event was a success and I was able to capture new customers that I can community upcomng new products and keep them happy campers”

Sarah Rose

FAQ

Frequently asked questions

Taking a business loan out for your business needs to be a calculated risk. Many fail to forget to invest the money into the task at hand.

What is Marketing Budget?

Marketing Budget is a platform designed to help businesses secure funding to cover marketing expenses, expand operations, and manage cash flow effectively.

What types of loans are available?

Marketing Budget offers a variety of business loan options, including SBA loans, startup capital, and creative funding solutions tailored to your business needs.

How quickly can I receive funding?

You can receive funding within 4 days, with a minimum loan amount of $25,000.

Can I manage my loan through the app?

Yes, there is an admistrative access that allows you to track expenses, manage funds, and allocate resources towards your marketing strategies.

What if I have poor credit?

Marketing Budget works with various lenders to provide solutions even for those with poor credit, ensuring there are options available to fit different financial situations.

How does the loan application process work?

The application process is streamlined to be fast and easy, allowing you to get approved and start using your funds quickly.

What should I use the loan for?

Funds can be used for a variety of business needs, including marketing campaigns, expanding operations, and other growth opportunities.

Are there case studies available?

Yes, the website features case studies showcasing how other business owners have successfully secured loans and grown their businesses.

How do I apply

Click here to start to fill out our online form. A representative will contact you shortly to explain the process with you further.